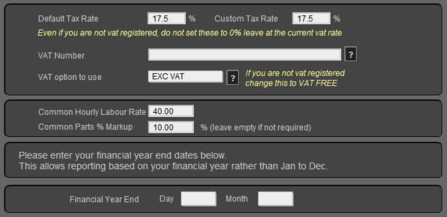

Here you can define your VAT number, Standard Tax rate and also a custom tax rate (more commonly referred to as reduced rate) These rates are selectable on the invoice screen by using a drop down box next to each line item.

If you are not VAT registered, leave the vat rates set as the current rate, however ensure that under the 'VAT option to use' you select 'VAT FREE'. This will ensure that each line item you add will automatically include VAT FREE without you having to select it on each occasion.

You can also set you common hourly labour rate, this will auto enter you rate against any labour line you add to a document, however the price can be over-written at any time, this is purely for convenience.

You can also set a % parts markup. If you set a % markup here, when entering a part onto a document, if you first enter a cost price, the retail price will be auto calculated based on this markup. Again, you can over-write this value at any time.

The year end allows you to produce reports by your financial year, rather than Jan to December, you are able to change this at any time and are not required to enter the information into this field.

|

Your VAT number will need to be manually added to your document templates via the Document Customiser section in the Admin area if you are using Portrait styled documents, however this is preset on the landscape layouts |

|---|